Federal Estate Tax Exemption Here To Stay

Since the passage of the Tax Cuts and Jobs Act (TCJA) in 2017, estate planning professionals and families alike have been watching the federal estate tax exemption closely. Many speculate whether the doubled exemption introduced by the TCJA, set to sunset in 2025, will revert to pre-2018 levels or be extended. Here’s my take, and it’s one I’ve held since 2018: the 2017 federal estate tax exemption isn’t going anywhere. I’m willing to bet it’s extended or made permanent.

Why the Federal Estate Tax Exemption Will Stay High

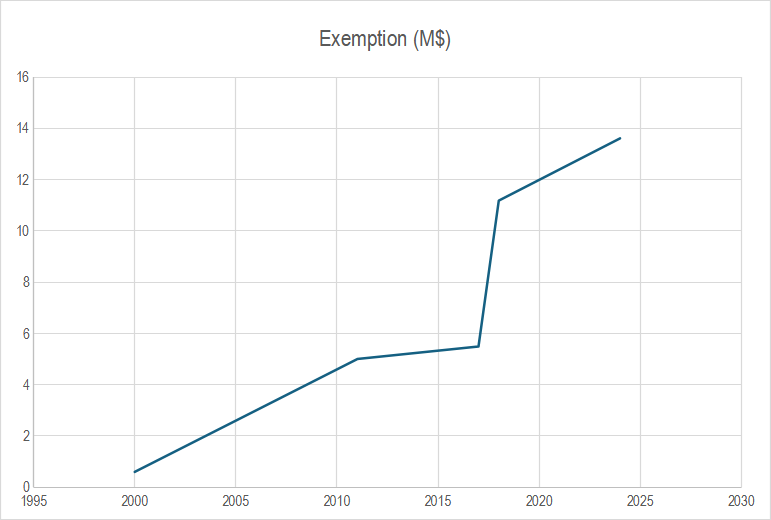

The federal estate tax exemption has been on a steady climb for decades. As the graph below (featured in my estate planning e-book) illustrates, the exemption has risen precipitously since the 1980s, with no historical precedent for significant reductions. To undo the TCJA’s increases would not only require legislative action but also need the support of a majority of U.S. Senators.

Let’s be realistic. Senators and Representatives often belong to the demographic most affected by estate taxes: high-net-worth families. It’s highly unlikely that Congress would voluntarily raise estate taxes on themselves and their constituents. Moreover, with the current political landscape, I assign a 100% likelihood that the 2017 exemption thresholds will either be extended or made permanent.

A New Era for Estate Planning Since 2017

The current exemption, indexed for inflation, stands at $13.61 million per individual or $27.22 million per married couple in 2024. This means that fewer estates than ever fall under the federal estate tax. Less than 0.2% qualify for estate taxes. Only 2 out of every 1000 estates reach the federal estate tax threshold. This simplifies estate planning and makes it more accessible, irregardless of income. If you’ve been putting off estate planning because of the perceived complexity of tax considerations, the good news is that planning today is simpler and less costly than in previous decades. Colorado has no estate taxes!

- Easier Planning: Families can focus on ensuring their assets are distributed according to their wishes without needing complicated strategies to minimize estate taxes.

- Affordable Solutions: With fewer tax complexities to navigate, more families can benefit from straightforward estate planning options such as revocable living trusts or testamentary trusts.

A History of Rising Exemptions

Looking back at the data, the exemption amount has consistently increased since its inception:

- In 1916, the exemption was just $50,000 (approximately $1.4 million in today’s dollars).

- By the 1980s, it climbed to $600,000.

- In 2001, the exemption jumped to $1 million, followed by increases under the 2010 and 2017 tax reforms.

The trajectory is clear: exemptions rise, and the likelihood of reversal is slim to none.

What This Means for You

If you’ve been waiting for clarity on estate tax thresholds before starting your estate plan, consider this your green light. The high exemption simplifies the process, but that doesn’t mean you should procrastinate. Whether you need a will-based plan, a trust-based plan, or help transferring assets, now is the time to act.

I’ve been designing estate plans since the 2017 TCJA took effect with the assumption that the exemption wouldn’t sunset—and I stand by that today.

Reach out to start your estate planning process and take advantage of this favorable tax environment. Peace of mind for your family’s future is just a conversation away.